3- There is no good way to account for going over-budget.

Since Mint doesn’t give us a good way to account for being over-budget in one category and under-budget in another category, it’s pretty hard to make sure each of your dollars have a place to go. We wanted to have all of our money going somewhere so that we could make sure we were paying the maximum on our debt.

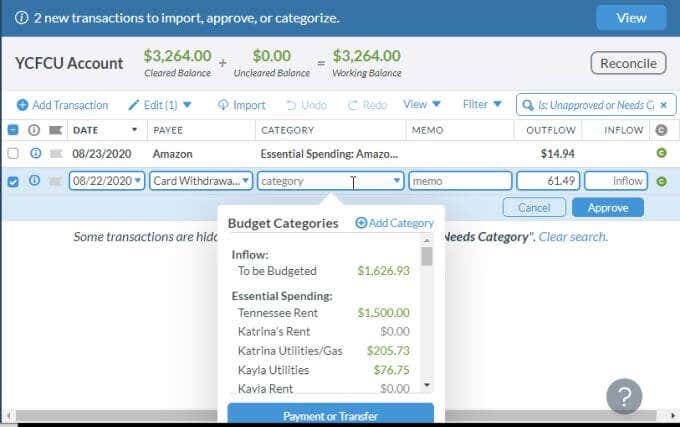

It is a record of the past, rather than a plan for the future like a budget should be.Ģ- Mint doesn’t work well for zero-based budgeting. The only time they come together is on the right side of the budget screen where Mint subtracts what you’ve earned so far with what you’ve spent so far. In Mint they are separate and distinct rather than integrated. Obviously income and spending are two vital parts of a budget. 1- Income and Spending in Mint aren’t connected. Mint is fine for seeing where your money went, but not a really good way of telling it where to go, which is what a budget should do. Here are a few of the specific problems we had with our Mint budget. While I like the convenience of having all of the info from various accounts all in one place, Mint isn’t really a budgeting tool. You can split transactions between multiple categories if you need to.

In order for your budget to be useful, you must categorize each transaction. Sometimes Mint does a good job of guessing, but it often gets the category wrong. Each time you log in to Mint you’ll want to take a look at your transactions to check the categories Mint has assigned each transaction to. For each category, you set a spending amount. You can set a budget with Mint by clicking on the budget tab. Each time we log into Mint, Mint logs into all of our accounts to bring us the current balances and transactions. We have all of our financial accounts connected to Mint (checking accounts, savings accounts, retirement accounts, credit cards, student loans). Since 2007 we have used to track our spending and budget. I’m really excited to share with you how we have overcome some of the stumbling blocks of budgeting and why switching from Mint to YNAB has totally transformed our budgeting! Mint

0 kommentar(er)

0 kommentar(er)